Transform your global money movement with Visa Direct

Visa Direct enables banks, fintechs, businesses and governments to transform the way they move money, all through a single platform.¹

With global expertise in money movement, Visa Direct provides a streamlined solution to address the complexities of domestic and cross-border transactions and currency management.

We are agile and proactive, so you can be too.

Move money your way

Connect around the world

Extensive 11B+ eligible cards, accounts and digital wallets.

Integrated 150+ currencies all over the world.

International 195+ enabled countries and territories reached through a network of 15+ card and 15+ real-time⁷ payment (RTP) schemes.

Discover how Visa Direct works for you

A better way to get money in

Collect³ business payments around the world or fund accounts quickly.

- Expand internationally: Receive funds from around the world - there’s no need to set up international accounts.

- Reconcile easily: Give customers peace of mind with automated reconciliation and unique account details that make matching payments to invoices simple.

- Manage costs: With no need for multiple banking partners to receive money internationally, you can save on banking and operational costs. Your customers can save too, by paying in their local currency and avoiding FX fees.⁴

- Enhance speed: Get money into your customers’ hands or your ecosystem fast.

Currency management made easy

Hold, manage and spend funds in 30+ currencies from a single, multi-currency wallet.

- Control: Manage your currency holdings, transactions and operations all in one place.

- Expand: Embed multi-currency wallets in your app and start serving global players.

- Manage costs: Hold funds in required currencies and help reduce costs by minimizing FX fees and the need for multiple in-country accounts.

More value from foreign exchange

Enhance currency conversion and trading, with added control.

- Global flexibility: Access competitive real-time⁵ rates with seven-day-a-week trading,⁶ allowing you to better manage your cash flow by controlling when to convert and book trades.

- Fee Transparency: Earn customer trust with transparent Visa Direct fees and accurate FX quotes with real-time⁷ monitoring of market performance that enables you to convert currency holdings at favorable rates.

- Cost savings: Save on operational costs and FX fees by using a single platform, while boosting your business revenue through customized mark-ups.

- Growth: Scale faster with our ready-made solution that supports various payment methods and offers a wide range of FX options to maximize value.

Global payments sent with speed

Access an extensive payment network that enables fast and secure domestic and cross-border payments in 150+ currencies.

- Speed: Benefit from the speed and convenience of fast payments that are processed 24/7 in real-time,⁷ or within 30 minutes for card-based transactions.

- Expansion: Accelerate your growth and support global money movement operations in an interconnected world by reaching over 195 countries and territories and accessing 150+ currencies.

- Transparency: Build customer trust with clear insights on payments which includes status visibility, delivery notifications, real-time⁷ tracking for SWIFT⁸ transactions and account validation.

- Innovation: Increase your speed to market with ready-made money movement tools: we’ve built the payment infrastructure, so you don't need to.

Find solutions made for business. Your business.

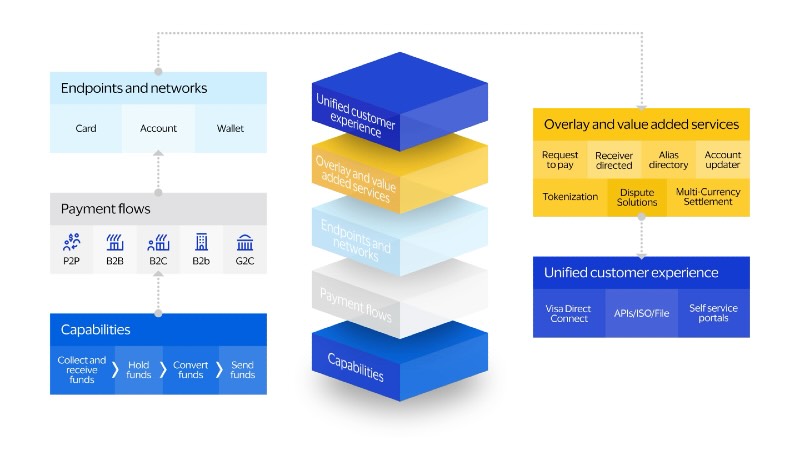

Customize your solution from a full suite of services

Stay informed and spark ideas

Want to learn more?

- Visa Direct Connect has limited availability and provides connection to select Visa Direct offerings. Please contact your Visa representative for more information.

- Visa Direct clients and participants should always consult and seek approval from their internal compliance teams on sanctions screening controls and processes, and are solely responsible for their own compliance with applicable laws and regulations. Optional compliance controls and risk management tools and services are provided solely for the convenience of sending acquirers, service providers, merchants, and recipient issuers / the Visa Direct clients and participants, and Visa makes no warranties with respect to them or their results. Visa Direct clients and participants are solely responsible for their own compliance with applicable laws and regulations.

- Certain domestic and cross-border collection, currency conversion, hold, and send capabilities offered through the Visa Direct platform are provided by Visa Australia Services Pty Ltd, The Currency Cloud Limited, Currencycloud B.V., Visa Global Services Inc., and Currencycloud Pte. Ltd. Currencycloud provides e-money issuance and/or payment services and is licensed and/or registered in Australia, Canada, the Netherlands, the United Kingdom, multiple states in the United States, and Singapore. Please contact your Visa representative for more information.

- Currency availability may be subject to limitations or change, including but not limited to factors such as client eligibility, jurisdictional limitations, and other factors. Please contact your Visa representative for more information.

- The frequency with which updated FX rates are available varies depending on product, geography, day of the week, holidays, or other factors. Please contact your Visa representative for more information about this program.

- 24/7 availability for the FX service is subject to client eligibility, jurisdictional limitations, and other factors. Please contact your Visa representative for more information.

- Actual fund availability for all Visa Direct transactions may depend on receiving financial institution, account type, region, compliance processes, along with other factors, as applicable.

- Payment tracking services, including SWIFT tracking, are subject to limitations, including but not limited to, capabilities and participation of the sending, intermediary, or receiving institutions.

- Use cases are for illustrative purposes only. Program providers are responsible for their programs and compliance with any applicable laws and regulations.